Earlier this year, I hit a $1M NW in 4 years starting from close to nothing in 2016. My next milestone is growing my NW to $2M by end of 2022.

As of now, my portfolio looks like the following:

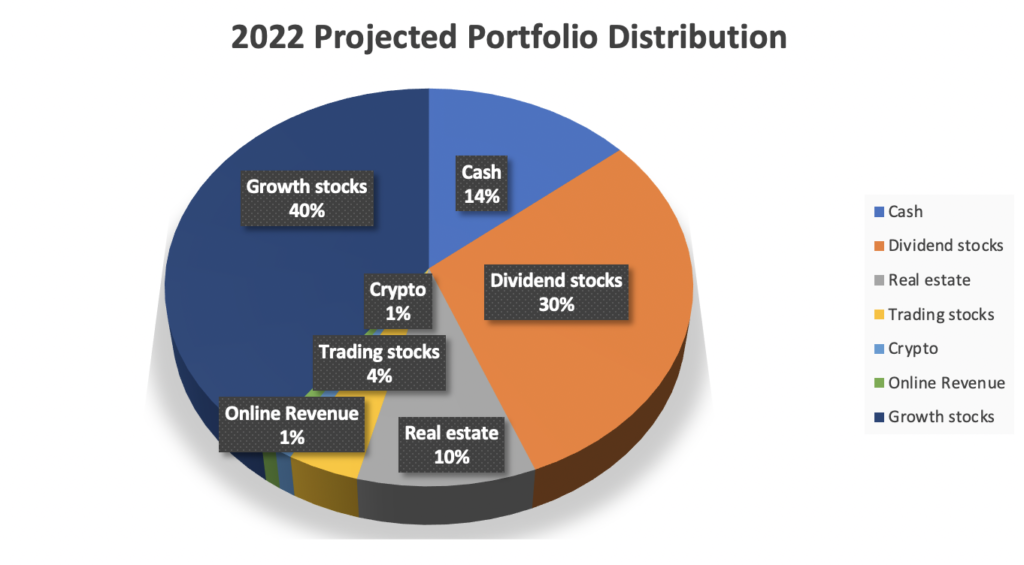

- 15% cash

- 30% dividend blue chip stocks,

- 5% for trading stocks – used to generate monthly income

- 50% in hyper-growth stocks – TSLA, SQ, ARKK etc.

Scaling my portfolio to $2M requires changing my strategies and setting new goals.

Over the next 2 years, these are my following goals:

- Invest ~10% of my portfolio on to real estate

- The real estate has to hit the following key metrics:

- ROI: Cash on Cash ROI: 7%+

- Number of units: 2+

- Neighborhood/Class: B or B+

- Median income of zipcode/neighborhood: $50k+

- State: landlord friendly – which means cannot be CA, OR, NY etc.

- The real estate has to hit the following key metrics:

- Create an online course and/or write 1 ebook:

- Course/book must hit the metrics:

- Income: People will gladly pay $199 one-time or $49/month recurring fee

- ROI: Completing course can give 500x ROI or $100k+ income.

- Field: Course/book needs to be in a super niche field with minimal competition.

- Peter Thiel said “competition is for losers”. Avoid competition.

- Course/book must hit the metrics:

- Rebalance my growth stocks exposure from 50% to 40% of NW:

- Automate 10% using M1 Finance (my stocks: https://m1.finance/NJu8DRLTYCqC)

- 30% of it self managed on growth stocks – as I am doing now.

- Continue Trading stocks using ~4% of NW.

- Trade under an LLC:

- Reduce Tax bills: LLC allows write off rents, phone bills as business expense.

- Increase Active income: Increase stock trading return by 20%.

- Trade under an LLC:

- Add crypto (BTC, ETH etc.) exposure – 2% of NW.

- Reduce cash to ~13% of NW.

- Don’t buy personal home.

- Keep Full-time job as is – autopilot mode and not get fired.

At end of 2022, my projected portfolio:

There’s no guarantee I will be able to hit $2M NW by end of 2022, but I want to hit the above goals, which I believe will set me on path to cross $2M.